US posted higher economic growth than China last year for the first time in decades. This was due to a strong government response to the pandemic and the underlying dynamic nature of the US economy that enabled it to weather the storm better than any other economy in the developed world. Also, some of the long-predicted issues with China’s economy, too much debt and financial sector issues, may be finally catching up to it and slowing its growth rates. Add to this the increasingly heavy hand of the Chinese central government in the private sector, and you have a whole new set of dynamics in the global stage. China’s recent push to exert more control on the private sector and its big companies could mean that they will become less competitive.

At the same time, a new US administration is taking a new approach and sees making investments in key areas as one of its priorities. These investments include infrastructure, which will improve the overall productivity of the economy and the workers (leading to higher wages.) Also, a push to invest in more education in pre-k and post-high school means a better trained workforce. Lastly, there is a strong bipartisan push to increase R&D investments in key technologies such as artificial intelligence, microchips, and nanotechnology. To all of this I say: Finally! For decades, these investments have trended down because cutting taxes as a way to stimulate economic growth became the norm in Washington and even after we witnessed decades of decline in America’s infrastructure and educational outputs, many refused to give up on this approach. I hope to see that these plans are fully seen through in the coming months and years. This will result in higher growth rates in US, as well as improving standards of living for everyone, especially those in the lower middle class and the bworking class. These groups have been harmed the most by the dogma that tax cuts will fix everything. That’s because they benefit the most from public sector investments in infrastructure, education, and technology.

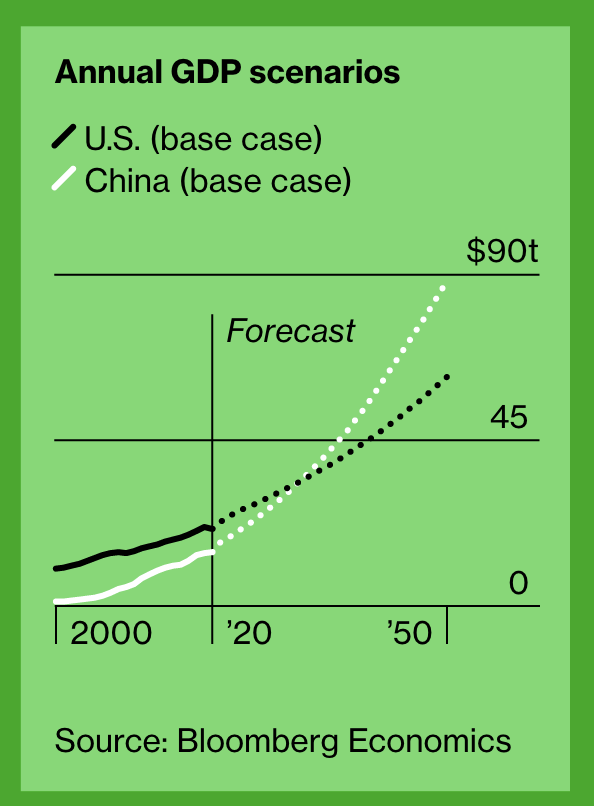

The proposed infrastructure and family plans represent trillion-dollar down-payments on doing just that. By lifting U.S. growth onto a faster track, they could delay China’s ascendency and keep US in the number one spot for good!

Bloomberg Economics has constructed various scenarios based on what could happen in each country and what those would mean for who ends up on top. Much has to go right for China to pass US as the world’s largest economy. This is a big question mark given some of the issues I have discussed in my recent posts. Also, if US gets serious about investments in its workforce, infrastructure, and technology, China will have far less margin of error. Could China stay on-course even if its leader installs himself as president for life and it starts to take a much more intrusive approach to the private sector? History suggests not but I say once again: China has proven most economists wrong again and again for a few decades. However, that was easier when their economy was very small and they could grow by becoming the world’s factory. To go to the next level, they will need to have some of the same foundations that supported Western economies to the levels that they are at today: GDP/Capita greater than $50K for most developed nations.

China’s rise to the number one spot in the world economy is not inevitable. US needs to get back to the playbook of making large investments in its workforce, technology, and infrastructure. These investments go further in US than other countries since it already has great institutions that can use these investments to create the next generation of technologies and build great infrastructure. This requires strong messaging by those who favor this type of approach vs. perpetual tax cutting and lower investments. The public needs to understand that these types of investments is how US became a superpower and a dynamic and prosperous economy. If many have been left out of much of this prosperity in the last few decades, it is because we got away from this formula. Getting back to it will improve the standards of living for many and ensure that US will remain the strongest economy in the world.