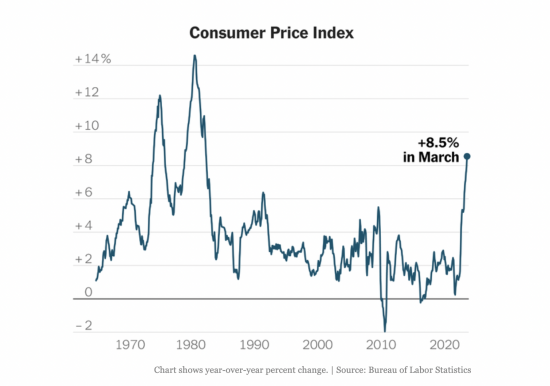

In the last post, we discussed the issue of the 4-decade high inflation and what is causing it. In previous posts, I had reviewed the data from the last few decades and how there has been a raging debate about why inflation has been so low for so long. All of a sudden last year, inflation began to pick up to levels not seen in a long time and it has accelerated since. Most economists believe that this is due to a combination of factors such as strong post-pandemic lockdown demand, government payments, increased household savings from government payments and lower household spending due to the lockdowns, and supply chain issues due to the pandemic. This high demand along with lower supply seem to be driving the current inflation. Many of these drivers are short-term and most people expect them to subside over the coming 12-18 months. However, there are some longer-term issues that may keep inflation higher than where it has been for the last few decades. One key driver is the rise in wages due to millions of people who have not returned to the workforce post-pandemic, coupled with high demand.

Businesses need workers and are paying higher wages to attract them. This is good news since there has been concerns for a long time that there has been a middle- and working-class wage stagnation. Most economists have blamed this on automation, globalization, lower demand due to “secular stagnation” and other factors. However, a spiral of increasing wages and demand can keep inflation hot and eat into the spending power of all families. That presents a big problem: We have been looking for ways to boost pay for average worker and it’s finally happening. But, we also don’t want it to increase too fast and lead to further inflation.

This is where fiscal policy and the Fed enter the picture. Faced with a hot economy and high inflation, the priorities could shift for those two entities. During the pandemic, the federal government paid families and businesses to help with the hardship caused by the pandemic and the lockdowns. This was to support the economy and families. The Fed lowered interest rates to make money cheaper and stimulate the economy by lowering rates for borrowing money for businesses and families. Well, all of that worked. The recession caused by the pandemic was very short and the economy began growing again after a few months. US is the only major economy that is now larger than before the pandemic.

Now, the federal government and the Fed want to cool demand to tame inflation. The federal government has to be much more cautious with transfer payments or tax cuts, policies that stimulate the economy. The Fed will need to raise rates to make money more expensive and make it tougher for businesses and households to get loans and thus cool down economic activities such as buying homes or investing in business expansion. All of this sounds in line with historic and conventional approaches to economic stimulus, inflation, and cycles. However, the big question is if the Fed or the federal government go too aggressive with cutting back on stimulus AND if the inflation drivers are gradually decreasing anyway, will the combination lead to a recession? How aggressive should they get with the current inflation, if some of the key drivers are temporary and it’ll come down gradually over the coming months?

This is a tough dilemma as it is increasingly clear that the Fed is not very good at predicting demand (neither is anybody else!) and their actions are based on their best guess on what will happen to demand. That means that they can potentially send the economy into recession by raising rates too aggressively, or not act aggressively enough to bring down inflation in a timely manner. Some people are forecasting a recession because the Fed has been too slow to raise rates to keep inflation from getting to its current levels but now getting too aggressive at a time when the drivers of inflation may be subsiding with time. They point to the yield-curve and how it might be predicting a recession in the near future.

We will examine whether that is the case and what the yield curve means and is currently indicating next.