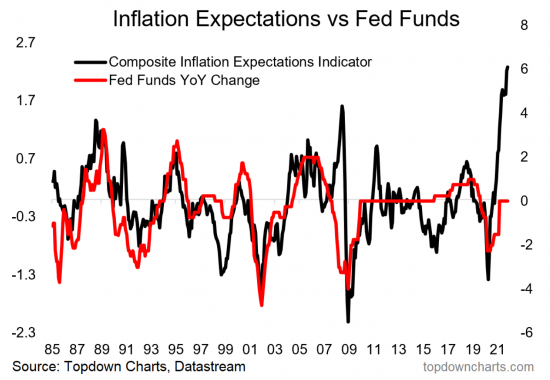

In the last few months, we have extensively discussed the issue of inflation. My focus has been on examining the drivers of inflation, why it picked up after years of dormancy, whether it’s transient (whatever that means!) and what are the short- and long-term implications for demand and growth. My view has been that many of the drivers are short-term (spike in demand due to government money and lower spending from the lockdowns, supply chain issues, etc) but certain elements of the inflation are more long-term, like wages. But, if the prices of home and rents keep rising without a similar rise in incomes, how long can this continue? Have we not seen this before where people bought things because they had short-term savings or mortgage rates were low and then see those prices collapse? Will we see that happen again given the run-up on rents and home prices?

One major issue is that supply chain issues due to the pandemic are believed to be a major driver of the current inflation problem. Supply chain as a driver of inflation is a thorny problem. When there are supply chain issues, companies order large quantities to make sure they have enough supply to deliver their goods. Well, what if demand level decreases and you now have tons of inventory? You will ultimately need to lower prices to move the inventory. That means falling prices! The opposite of inflation!!

Well, are we seeing any of that? Does it mean inflation is about to fall? The answer is that we are not immediately seeing any major indicators to suggest that supply chain issues are resolved, that companies have too much inventory, or that demand is falling. For example, there is great fear that China’s COVID issues and the lockdowns in major hubs like Shanghai will have a detrimental effect on the supply chains for the near future. However, there may be very early signs of softening of demand and orders for supplies. In an article in Bloomberg Businessweek last week, data is mentioned that the freight industry is starting to notice softening in demand and easing in prices. This may be due to over-ordering last year when companies were worried about not having enough inventory and now they need to move that before they re-stock.

As you can see in the graph, the level of inventories are way above their averages for November (year’s high) and February (year’s low) over the last few months. This means that companies will need to decide if they continue to order because they believe demand will continue to be robust or pull back and move the current inventory. If it’s the latter, prices will start to fall because they will need to provide discounts to move those items.

In the next post, we can talk about demand, the Fed, and the coming months.