So, now you are the US government, the number of people in Medicare is increasing and they live longer and get better and more expensive treatments for their heart disease, arthritis, and Alzheimer’s and you have to pay for all of it.

Economic growth is around 2-3% annually, which means the tax revenue coming in is not nearly enough to keep up with the rise in healthcare costs.

Well, government and insurance companies have tried many things over the years to curb the growth in healthcare costs.

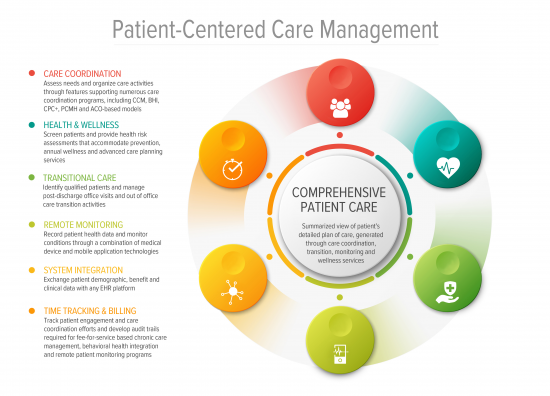

These include incentives for people to change their behavior so they would be healthier and use less healthcare services. Such incentives included premium discounts for not smoking, losing weight, taking their medications, and other things. Also, they tried disease management services that included focusing on certain high cost diseases such as diabetes and heart failure and making sure people with those conditions were treated well so they would have less complications.

Whether these programs had any impact on the rise in healthcare costs is debatable, but what is clear is that the costs continued to rise at a brisk pace.

In the last decade, Medicare and commercial payers have been experimenting with payment models where providers are incentivized to take responsibility for the outcome and overall costs of care of their patients.

The idea behind this is that only providers have the knowledge and relationships to impact the outcome of their patients’ conditions.

Patients who have been reluctant to participate in disease management programs run by insurance companies seem much more open to the idea if it’s through their own doctors. Providers have to get used to a new kind of care: one that pays them to keep their patients healthier rather than by the volume of the patients they see or the number of procedure they perform. Initial data shows promising outcomes and pioneer provider institutions have shown reduction in overall cost of managing a population of patients.

Next, we can see whether and how all of the current changes may add up to increased coverage and reduced costs.