Every channel you tune into these days, every newspaper you read, and every website you visit, there is one topic that is dominating the discussions: inflation! Even those with little interest in economics or politics are getting into the discussion. Why? We have had inflation in the past. As a matter of fact, the six percent annualized inflation number that just came out is less than half of what we experienced in the seventies and early eighties. So, why is it scaring so many people this time? Whose fault is it? Is it really something to panic about? Let’s talk about some of these topics over the next few posts.

Inflation in and of itself is not bad. As a matter of fact, when I was studying economics in business school, 2-3% percent inflation annually was considered a good thing. It served to allow for small, steady raises to employees that maintained their purchasing power without the companies suffering big erosion of their margins or having unhappy employees. And, 2-3% inflation is exactly what we have had for decades now. This had been the case even in boom economic times of the nineties.

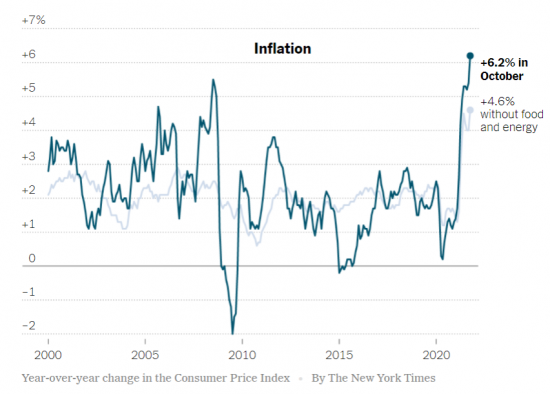

It wasn’t too long ago that I was reading articles in reputable journals such as Bloomberg Businessweek with the titles like “Who Killed Inflation?” and the discussion centered around the fact that we have not seen meaningful inflation for a long time. Even after we mostly recovered from the Great Recession of the 2000s and the labor markets became very tight (unemployment was 3.5% in February 2020) we did not see significant inflation. This resulted in many of the old orthodoxies such as full employment levels (assumed to be ~ 5% historically but now who knows??) being questioned. As a matter of fact, there was real concerns about long-term deflation, similar to what we’ve seen in Japan for over two decades. As you can see in the figure below, the inflation level in recent years and decades has been very low by historic standards.

Figure – Long-term US Inflation Levels

Given the persistent low inflation for so long and some of the long-term forces that seemingly caused that low inflation (globalization, automation, aging population, etc,) and the fact that many of these forces are still in play, we can probably safely conclude that at least some of the forces that are causing this sudden surge in the inflation outlook are temporary. The pandemic has turned everything upside down and we are seeing an unexpected economic cycle. Prices for everyday items like used cars and food are experiencing a sudden jump without a corresponding long-term rise in the overall wealth and spending power of the majority of people. Yes, we’re seeing a robust labor market and finally, some wage increases. However, the aggregate demand for used cars and beef have not surged so much that the short-term price increases can be explained by these recent wage gains alone. Most likely, a rebound in demand post-pandemic, coupled with supply-chain issues (e.g., microchip shortages,) explains a large chunk of the level of inflation we’re seeing at the moment.

In the next post, let’s examine why inflation has been so low for so long and whether there is a fundamental change in any of those drivers.