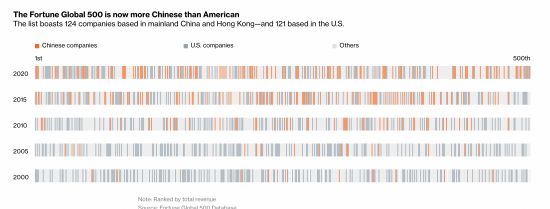

In the last post, we discussed China’s astonishing economic growth over the last few decades. As a result, it is now the world’s second largest economy and continuing to gain on US. This is not just the size of their economy but also their overall confidence in the international sphere and challenging the West for economic and technological supremacy and influence. If they continue on their current pace, they can re-write the rules for international commerce to suit their interests over others and spread their influence and system of government, authoritarianism, around the world. Already, we see their aggressive behavior toward their neighbors in the South China Sea, Taiwan, and other Asia Pacific nations. We have all seen what happened in Hong Kong when they took over. We can expect more of the same if China continues on this path.

The question here is whether they can continue on this path of rapid economic growth? Will their growth rates continue to exceed those of the US and other major economies?

For China’s economic miracle to continue, they need to continue with their market economy that fosters innovation and entrepreneurship. They need to allow market forces to drive which sectors and companies attract investments and drive economic growth. Central government intervention can be helpful in the short-term during crises or when there are excesses in a sector that can threaten the rest of the economy. However, long-term continued intervention by the government where they do not allow inefficient companies to fail, winners are picked by their connections to the Communist party rather than the best business models, and where massive overcapacity is created in critical sectors, is not a recipe for long-term success.

We have seen plenty of this in the Chinese economy in the last few years. Central government has directly intervened in the economy in the favor of certain companies, in many cases State Owned Enterprises. This means that the best companies that would be internationally competitive might have been intervened against in favor of companies with connections to the Communist party. Bank loans extended to the companies that were not credit-worthy because of their connections. Consequently, rather than survival of the fittest economically, you have the survival of the companies favored by the State.

Why, then, all of this has not led to a slowdown of the Chinese economy? That answer to this question is complex. First, China’s growth rates have dropped to below 5% already. Second, China has the largest population in the world and lots of room for growth before these missteps result in long-term slowdown of their economic growth. There is still low hanging fruit in their economy that can continue to drive growth. Those opportunities were exhausted in the West long ago. They continue to move people from rural areas into urban zones and employ them for production of goods that they export to the rest of the world, or for their own expanding domestic market. The lower wages for this, still large untapped, workforce means that companies see it as a place to outsource production to lower costs.

Also, the Chinese government has increasingly expanded their investments in scientific research and development. It seeks to become a global leader in areas from artificial intelligence to biotechnology and green energy. This is while US has not kept up with this type of investment as a percentage of its GDP over the last few decades. This has opened the door for China to do major catching up. This is on top of their aggressive investments in infrastructure in the last few decades while US investment in its infrastructure dropped.

There are other major developments in China that will have major implications for their continued growth that we will examine next.