Given all of the complexities we discussed for the investors as they evaluate health AI solutions, you think there’s plenty to worry about already for potential investors. Well, maybe! Another issue that I think the investors should keep in mind is that the development, implementation, and maintenance of health AI solutions is complicated. That means a startup with an innovative solution may not be equipped to solve all of the ancillary issues that need to be addressed before the buyers can start using those solutions. But, larger companies with all of their resources may be better positioned to take on this complex process. The size of the prize is large enough that it could be worth their while.

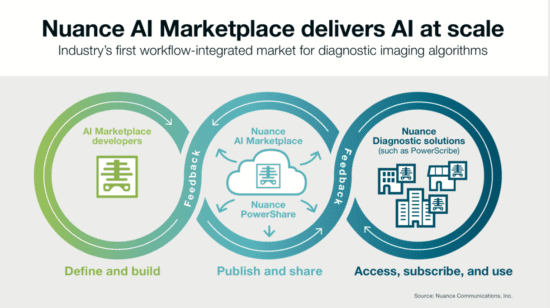

Allow me to introduce Nuance AI Marketplace, an open platform that’s designed to help developers, data scientists and radiologists to accelerate the development, deployment and adoption of AI in medical imaging. The company has a partnership with the Massachusetts General Hospital (MGH) to make their internally developed radiology algorithms available in the Nuance AI Marketplace. Some are FDA-approved. This means that commercial companies with FDA-approved radiology algorithms that perform the same function are competing with MGH on the Nuance marketplace.

Once on the Nuance marketplace, the algorithms can be directly embedded into radiologists’ workflows using reporting tools like Nuance PowerScribe One. This shows that larger companies, like Nuance, are carving out key roles for themselves. They don’t necessarily need to develop the algorithms, but they can make them available to everyone once they’re cleared by the FDA. Since Nuance is helping with the implementation of medical algorithms for health systems and providers, it incentivizes them to buy the Nuance platform so that they can find and activate AI solutions quicker and more easily.

For smaller companies, there are many pitfalls in getting into the AI business. They include having to assemble large, well-annotated data sets, the ability to use huge amounts of computing power, and the technical skills required to build the models and integrate them into the complex web of information systems at health centers. This may be beyond the reach of smaller, more innovative companies which could develop algorithms, but which might struggle to operationalize them. As such, larger companies like Nuance could create the ecosystem that these algorithms will launch in. This means that the established companies with diverse capabilities will be vital for the future of AI in Healthcare.

Philips has developed an AI-based tool called Illumeo, for radiologists, which can display contextual information about patients alongside their images so that physicians don’t need to hunt around for that information.9 Better still, it can anticipate radiologists’ needs, such as by automatically suggesting the right tools to use to measure and analyze blood vessels. It can even learn individual user preferences, or what’s known in the industry as radiologists’ “hanging protocol”.10 Phillips is one of the major hardware and software vendors for radiology, and incorporating new AI solutions into their existing user-base would allow their customers to benefit from these solutions inside their existing workflows. This highlights opportunities for the companies developing these solutions to interface and fit inside legacy systems—or even to develop them specifically for those systems. That would improve the odds of a successful exit.

I don’t believe this is necessarily something that should keep investors from investing in a promising health AI solution. If you’re evaluating an investment opportunity in this sector, the company should show that they understand the ecosystem that they will be playing in and how they plan to protect their product and business model against the bigger players. Better yet, how do they plan to build it so they become an appetizing acquisition target for those larger companies.