As we turn our attention to a new year, those of us who live and breath healthcare are holding our breaths to some degree! Why? A slew of major legislative and policy changes in 2025 are creating new dynamics in this massive and complicated sector. Policy changes can create instantaneous winners and losers and if they’re monumental in nature, they can create large numbers of those. So, what happened in 2025? and why were those developments so massive in nature that they’re creating a dark cloud over what’s next for healthcare in America?

Two of the most important policy changes involved insurance eligibility issues and the resulting loss of coverage for millions of people. In an article on July 8, 2025, titled “What Does The New Legislation Mean for Patients and Healthcare Providers? Part I” I discuss that the “Big Beautiful Bill’ (BBB) included provisions that removed the eligibility of millions of people who began receiving subsidies to buy health insurance on the state exchanges during the pandemic. As I mentioned in that article, in 2020 during the pandemic, the Families First Coronavirus Response Act (FFCRA) provided a temporary 6.2 percentage point Federal Medical Assistance Percentage (FMAP) increase and required states to maintain enrollment of nearly all Medicaid enrollees. Additionally, many states took steps to expand coverage or reduce enrollment barriers for children. This resulted in expansion of health insurance coverage to millions of additional people and the percentage of the uninsured dropped to ~ 7%, the lowest on record. In March 2023 The pandemic-related expansion of Medicaid benefits, specifically the continuous enrollment provision, ended. This resulted in an uptick in the number of uninsured, though the percentages stayed well under 10% in 2024. With the rollback of the eligibility for more people currently on Medicaid in 2025 the estimates are that 10-15 million people will lose health insurance coverage. This is set to take effect in 2027.

Another major development, and a more immediate one, is that some of the subsidies for Obamacare exchanges are being rolled back, or to put it more accurately, are not being renewed starting January of 2026. This means that millions of additional people will not be able to afford to buy insurance and will lose their coverage. All of this will add up to financial challenges for healthcare providers and patients. Most medical institutions are undertaking major steps to prepare for this financial tsunami. While not having coverage will mean that many of those people will skip necessary medical visits and procedures, including preventive and screening procedures, many will seek care out of necessity and won’t be able to pay for it. This will significantly increase the amount of non-reimbursed care at these institutions on top of lower volumes of visits and procedures. This lower revenue is especially problematic for provider institutions since most of their expenses are fixed. These include facilities, salaries, medical equipment, and more. As such, some of the first steps they’re taking to deal with this include eliminating or consolidating service lines, cutting staff, and negotiating higher fees for the existing services from insurance companies.

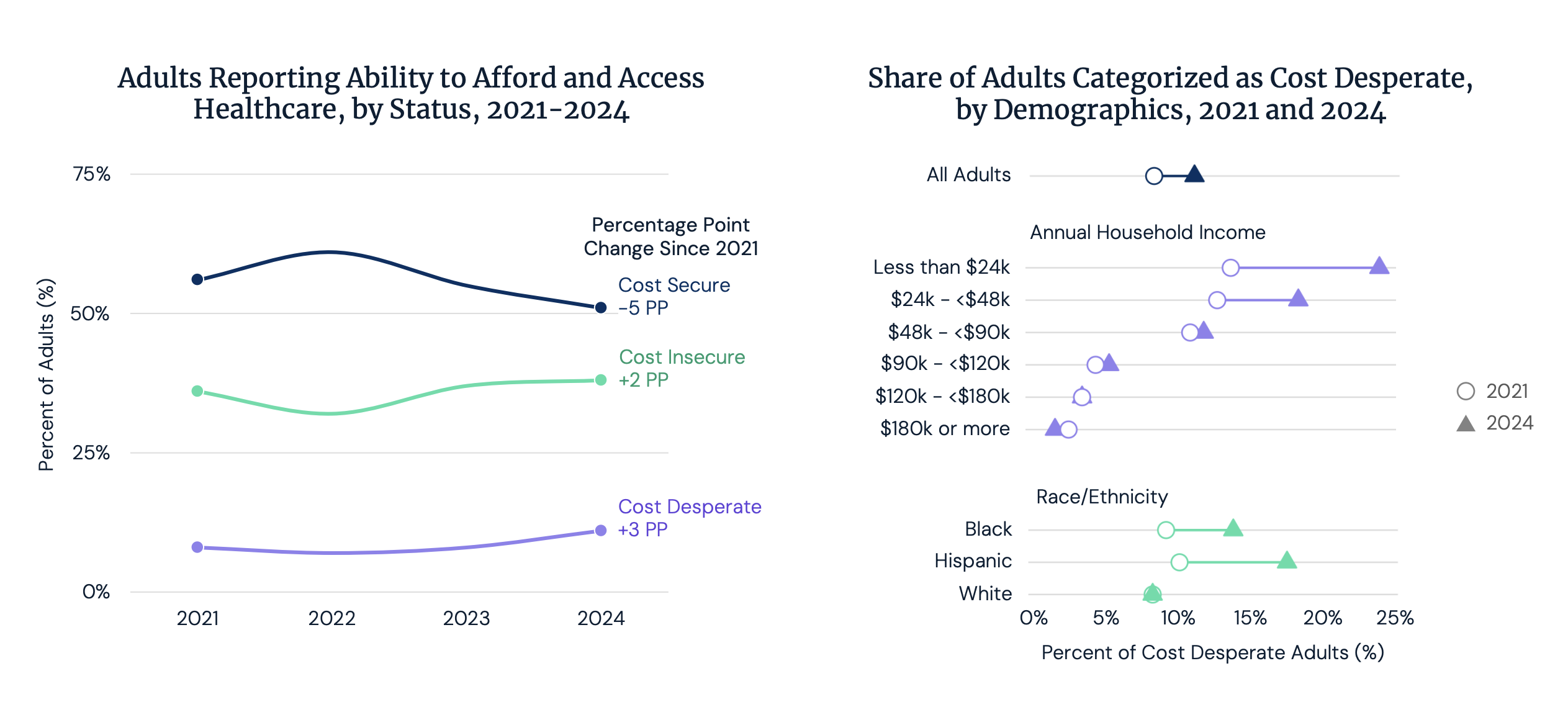

Source: West Gallup Healthcare Indices Survey, 2024.

This last step is especially relevant for the rest of us. When medical institutions provide non-reimbursed care, they need to subsidize that by getting paid more for the care they provide to others, so they can handle the cost of the free care they’re providing. In fact, for decades, there has been an implicit agreement between the government and commercial insurance companies. Since government started cutting reimbursement rates for Medicare and Medicaid patients in the 90s, they have adopted a light regulatory touch to the commercial insurers as long as they paid a higher rate for the same procedures to make it up to the providers. This has kept the providers in business and allowed government to keep their healthcare bill under some control. After all, when government insurance programs went into effect in the 1960’s, life expectancy was much lower and the projections of the total cost to the federal government were based on a much younger and healthier population. All provider institutions try to maximize the revenues and margins from their commercially insured patients in order to increase revenues and make up for the lost revenue for the charity care they provide. This phenomenon will increase because of the millions of people losing coverage. So, sooner and later those insurance companies will need to raise their rates to cover the higher fees that the providers will try to extract from them.

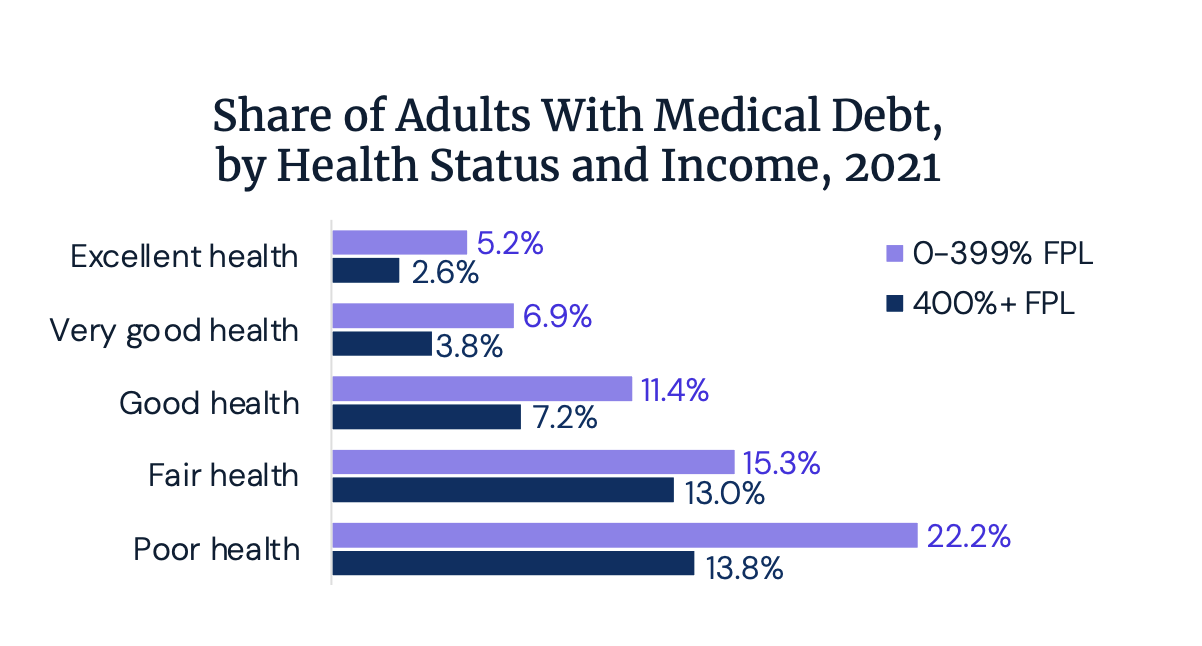

Source: United States Census Bureau Wealth, Asset Ownership, & Debt of Households Detailed Tables: 2021.

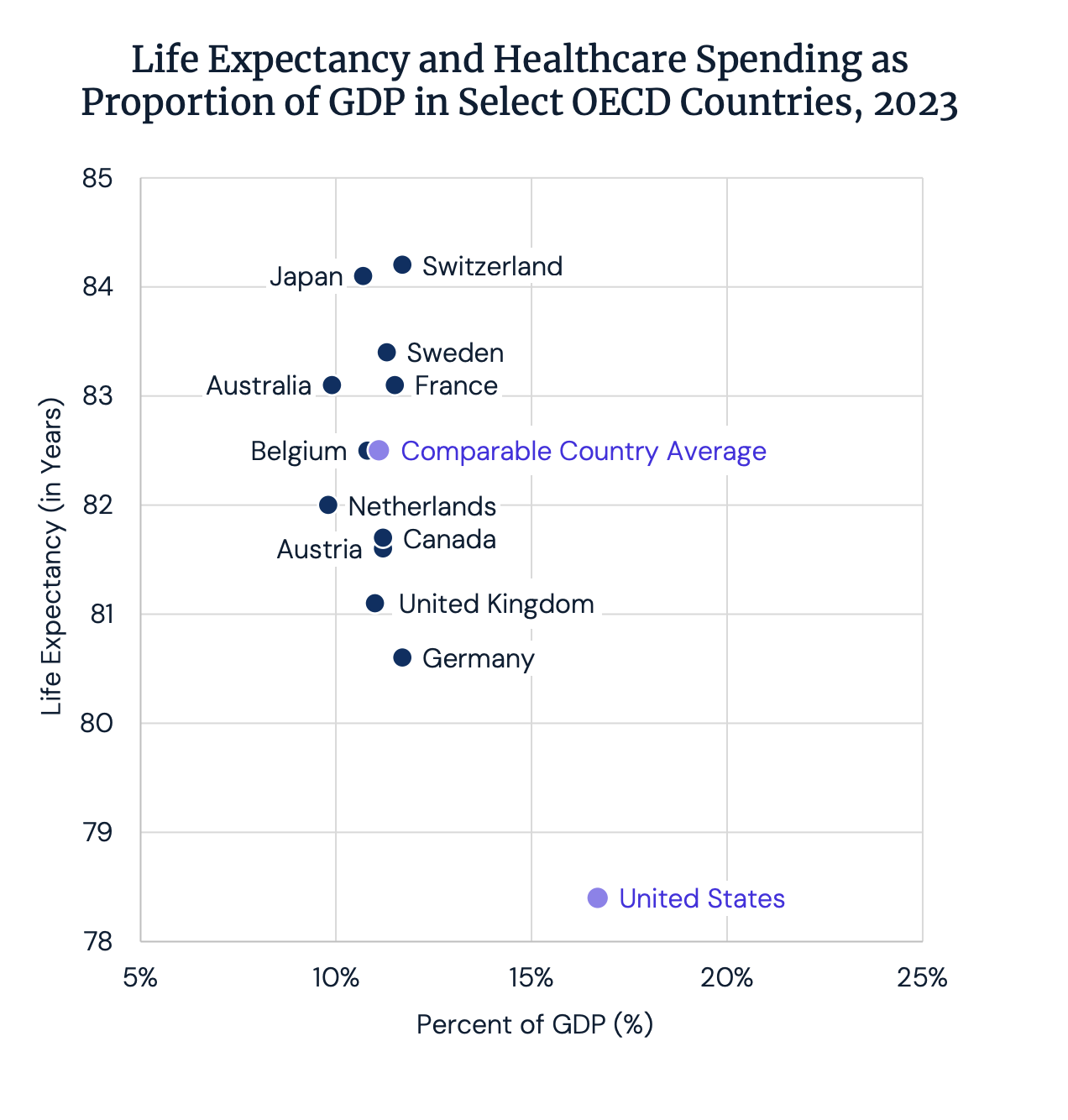

Another key item to remember is the impact of all of this on the long-term healthcare bill of the nation. As you can see in the figure below, United States is an outlier in how much we spend on healthcare per person every year. This is while we rank 49th in life expectancy and have some of the worst outcomes of any advanced nation. We also happen to be the only advanced country that doesn’t provide insurance coverage for every citizen. Is there a link between these two? Absolutely. Not providing coverage for large swaths of the population does not mean that we save money. It just means that we’re deferring those costs and will pay for it later and in much larger amounts. People who lack coverage skip screening tests and preventive care. These are the visits and tests that catch a pre-disease state and can help prevent it from advancing or find a disease early when it can be treated far more cost effectively. People who are losing coverage will show up to a medical institution near you sooner or later with advanced diseases that will require expensive therapy. That care will be paid for by a government program that they’re now eligible for due to their age or financial situation (medical bills are the number one cause of bankruptcy in America, even for people with insurance!!) The flywheel will the continue with escalating costs, worse outcomes, and budgetary pressures on the federal government.

Source: World Health Organization

One way that some medical institutions are preparing for the coming financial challenges is through investments in technologies that will help them do more with less staff, most notably AI.-enabled solutions. Investments in ambient scribe to help doctors with note-taking, chart summarization features within their EHRs to save time for doctors and medical assistants, passive monitoring technologies to help their nurses, and more are examples of this. On the other hand, many smaller and rural institutions don’t have the budgetary room for these types of investments. For them, it’ll be lowering their service levels and serving less people or shutting their doors. Indeed, much uncertainty as we enter the new year!