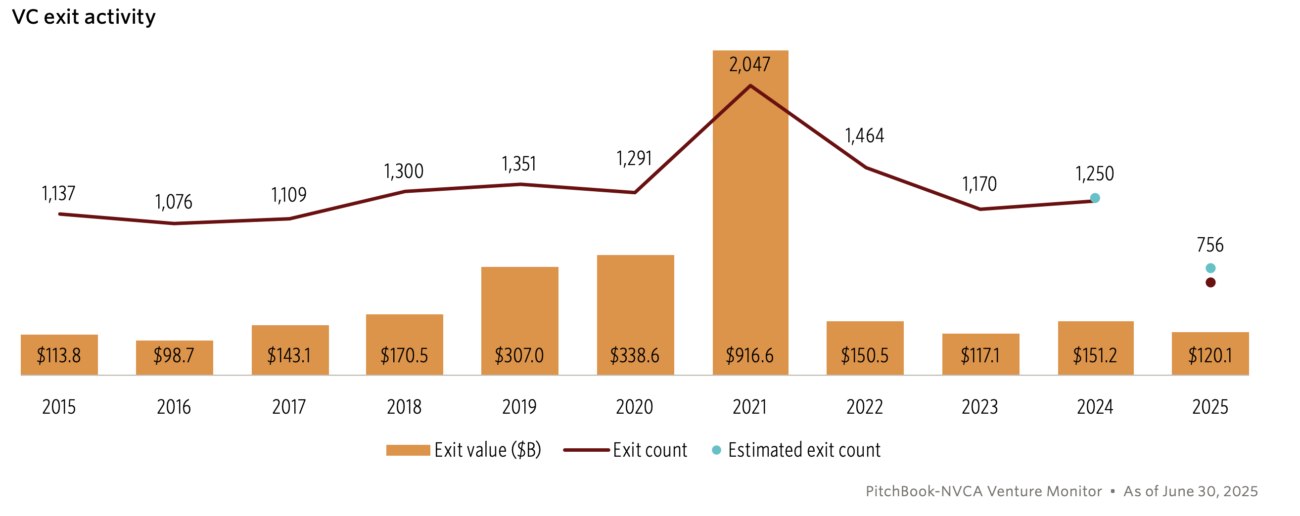

Back in March, I wrote about the state of private market investments in health AI. While my focus was digital health and more specifically, health AI, the macro trends in private market investing, and especially VC investing was a major focus of that piece. The inventory of companies that raised large sums of money in 2020-H1 2022 at high valuations but have not been able to meet their growth projections, raise follow-on rounds at stepped up valuation, or achieve meaningful exits serves as an overhang over the entire asset class. They represent Net Asset Value (NAV) for VC companies of over $3 trillion that need to reach a conclusion and be cleared off of their ledgers. Ideally, that conclusion is a large public market entry or being acquired by a strategic company or bought out by a private equity (PE) firm. All of these represent liquidity events for the shareholders of these companies, including their venture investors who can distribute capital back to their Limited Partners (LPs.) Those LPs, happy to earn a nice return on their VC investments, will then write more checks to those VCs again so they can invest in the next generation of great companies.

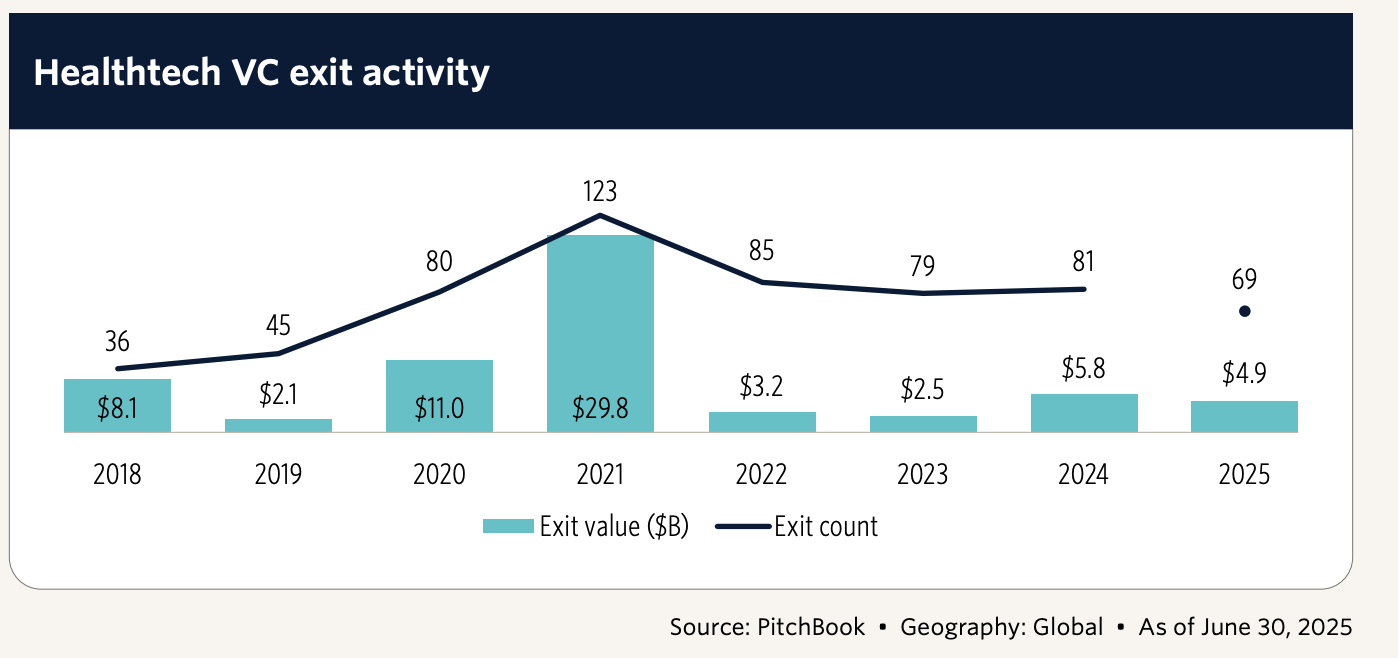

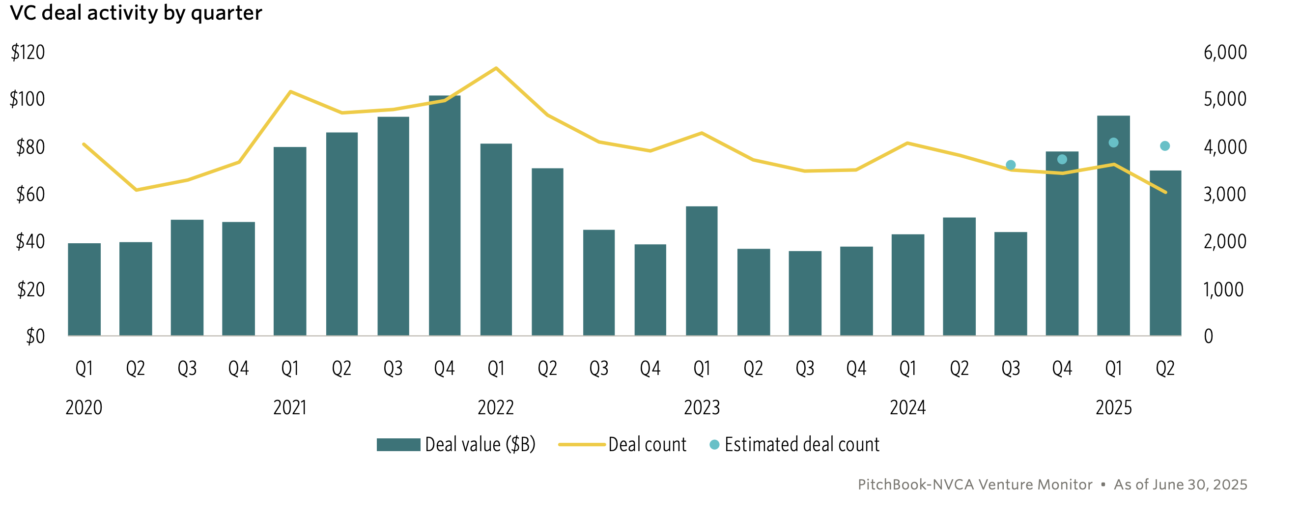

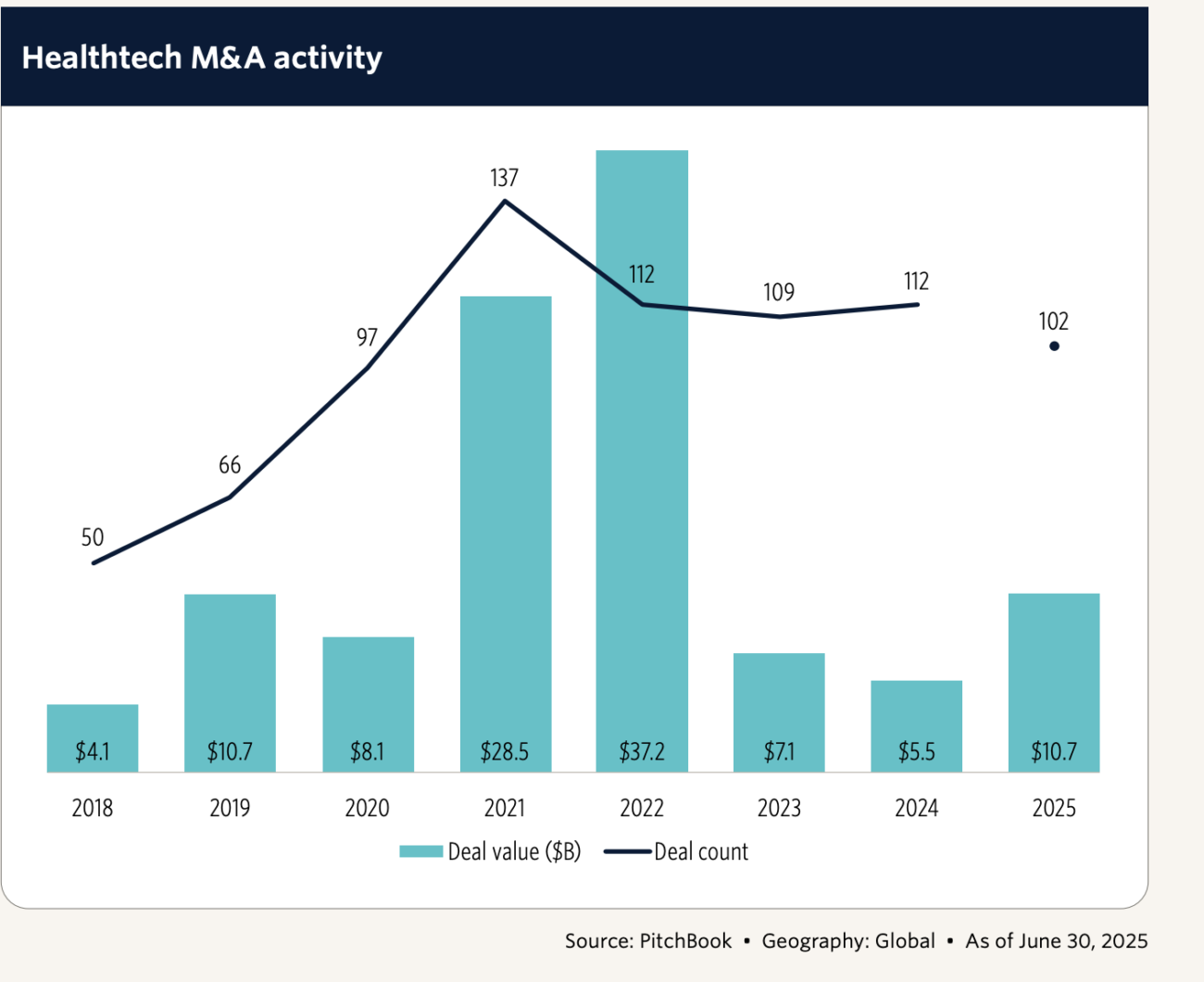

This flywheel, unfortunately, has been slowed down over the last few years. Many of the high number of companies that managed to raise money in the zero interest rate era and often a inflated valuation now serve as a cautionary tale for the industry. And cautious they’ve become. While the dollar amount of VC deals has begun climbing again in the last few quarters, an interesting pattern is emerging. The number of deals seems to be continuing to drop from the peaks of 2021 while the dollar amounts are climbing again after a few years of dropping from the 2021 highs. This means that fewer companies are receiving funding, larger checks are going to the winners, and the rising deal value is being driven by some outsized rounds for the likes of OpenAI. So, the total dollar amount invested is misleading in describing what’s really going on in the VC funding space. As a matter of fact, Q2 2025 saw one of the lowest deal count totals in years for early-stage technology firms. Part of the explanation for all of this is that the VCs need to achieve some exits for their portfolio companies and are cutting back on early stage investing to give money to later stage deals that can get to an exit in a shorter time frame so they can distribute capital back to their LPs. Also, in a risk-off environment where they can’t afford more companies sitting in their NAVs with no path to an exit, they would rather write larger checks to safer bets.

All of this can be unclogged if the exit markets, i.e., IPOs and M&A, open up again. That was the hope coming into 2025. Back in January of this year, there was great optimism that a new pro-business administration would crack the slow exit markets open and there would be a flood of companies going public and the large corporations, under less scrutiny from the SEC, would start acquiring again. Unfortunately, all of that has played quite differently than expected. While there have been some large IPOs, including in healthcare, the exit markets have not snapped back with force. The reasons for this are multifold. One factor has been the fact that inflation has turned out to be more sticky than expected and the rate cuts that started in September of 2024 were by in large paused after early 2025 data showed that the progress toward the Fed’s 2% goal for inflation had stalled. This was compounded by the announcement of wide tariffs in early April that sent the markets tumbling and raised the fears of rising inflation again. What was once believed to be an inevitable series of rate cuts after having successfully achieved the much coveted soft landing turned into months of wait-and-see about the inflation data. This iced a lot of the anticipated deal activity and some of the companies that had filed to go public delayed their public debuts in the hopes of less volatility and lower interest rates, which often supports higher asset prices.

While the Fed finally cut rates in September after 3 consecutive months of poor job reports, the inflation issue and the potential impact of the tariffs haven’t been fully resolved. So far, the effect of the tariffs on inflation have not been as bad as feared. While many of the tariffs were paused shortly after being announced, the deals that have been announced since then still represent an average tariff rate of around 18% vs. the 3% prior to April. Some economists have estimated that these tariffs will represent 0.5% slower GDP growth annually moving forward. This presents the dilemma of a potentially slowing economy, slowing job growth, and higher than desired tariffs. Not the dream scenario that the investors have been hoping for to clear the backlog of companies sitting in their NAVs and restarting the robust flywheel of funding the next generation of innovative companies and raising their new funds. I wrote about the threat to our innovation economy from these dynamics in the private markets plus the federal cuts to the basic science R&D in a recent article for Fast Company.

The implications of all of this for the innovators out there who need funding for their ideas and companies is that they need to build their companies in a different way than has happened in the recent past. Not too long ago, growth at any cost was Silicon Valley’s MO! Investors poured in big bucks into companies that were nothing more than an idea on a piece of paper and a charismatic founder. Those days are gone. Companies need to have more milestones under their belt to raise money at every stage. High net burn rates are not something to be proud of any more but rather something that can keep you from getting funded. Promising technologies need to be coupled with credible commercialization plans and people who have a track record of pulling it off. Being a repeat founder helps even if you did not have an exit from your previous company as experience is valued (most successful founders are repeat offenders.)

While there’s still plenty of money in the private markets and in VC, it’s being more concentrated in fewer companies, so if play by these new sets of rules, you’ll have a better chance of getting some of it!!