AI-based solutions will face skepticism and have a tough road ahead before they gain adoption, even if they’re solving clear, unmet needs. That’s just how it is in healthcare. Changing the practice of medicine isn’t easy, but changing the business of healthcare is a little easier. So, what are the right business models for companies that are innovating in healthcare AI? How can the investors separate the winning companies from the pack?

First, there are several business models that could work. Successfully commercializing these technologies to providers, consumers, and life science companies will probably require different business models. Within the healthcare delivery system, business models are notoriously complex and not for the faint of heart. The end users of healthcare products (providers or patients) are usually different from the people who decide if they should be using the AI solution (executives or providers); those who pay for it are different to those who prescribe it; and those who approve the marketing of the products (e.g., the FDA) are different to the ones paying for it. For technologies like radiology AI applications, which could be used by healthcare providers to do their jobs more effectively, the FDA approves it, health system executives decide if they can buy it for providers, and payers decide whether to reimburse for it.

Unless innovators figure out how to successfully commercialize AI-based products or services, the sector will struggle to grow. We’ve seen many of the companies that are developing healthcare AI solutions raise a large amount of capital and show increasing valuations with subsequent rounds of financing or with successful IPOs. However, we’ve seen less evidence of significant adoption and revenue growth from commercializing those technologies. This may be because the buyers of these technologies—such as providers, payers, and life science companies—are still learning about the use cases and their impact on their business model. As they become convinced of their value and their impact on the bottom line, we can expect them to accelerate their expenditure on AI technologies as a new way to deliver care, develop new diagnostics or treatments, and improve their operations.

The investors who are evaluating health AI companies need to be convinced that the solutions under assessment can deliver immediate ROI for their customers. One of the areas where these solutions can show ROI and is often overlooked is boosting revenues for these customers. When it comes to AI, the conversation often revolves around improving operations and decision making. That can result in cost reduction or better patient outcomes. Or, in a life science company, it can improve the R&D process. Improving R&D is great and can result in better diagnostics or therapeutics long-term, but it’s not a compelling short-term business impact. Also, improving patient outcomes may not immediately result in better revenues if the solution is not reimbursed by the payers. Or, does it?

All of the customer segments we’re discussing are trying to increase volumes and market share. Medical centers are engaged in local competition with each other and are trying to attract patients. Life science companies are trying to increase market share for their drugs or devices. If using an AI solution can improve the management of stroke patients, that medical center can use that in their local markets to attract more of those types of patients. If using AI improves the patient experience with a drug or device, doctors are more likely to prescribe it over its competitors. This is a compelling business case and one that often is not fully explored by these companies or their customers. Many think that if their solution is not reimbursed, then the revenue side of their ROI does not exist or is too hard to explain to the customers.

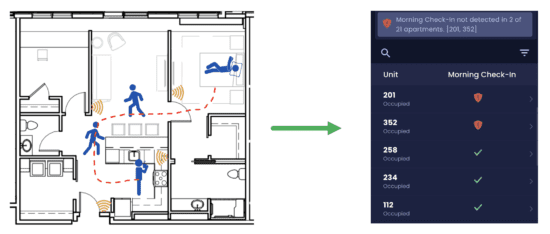

One example of this is passive monitoring of residents in long-term care facilities. Currently, if there is any type of monitoring of these residents, it’s with the use of a wearable or with cameras. Well, the experience with these types of monitoring so far hasn’t been good. Nobody wants to be watched in their place of residence. Also, cameras can’t be placed in bathrooms, where 50% of the falls occur in these facilities. Wearables have turned out to be problematic. People lose them or drop them and then don’t replace them due to the cost. Passive monitoring uses invisible sensors such as radar or infrared plus AI to analyze the signal from these sensors. The result is detailed monitoring of the residents in every room, Not only you can detect any falls, you can also start detecting a worsening gait, frequent trips to the bathroom, increased time in bed, lower activity levels, etc. Any of these can mean worsening physical issues or a new illness. Often these can be addressed if caught early enough. That means the resident stays in their unit and does not get transferred to a hospital. That improves occupancy rates in these facilities, which is critical to their profitability.

This means that the facilities using passive monitoring can market their centers to potential residents by touting the fact that instead of using cameras or wearables, they use invisible monitoring that does not spy on the residents but can detect brewing issues early on. This is a source of competitive advantage and a compelling reason for the potential residents and their families to choose those facilities over other local competitors. This is a strong business case for this type of health AI technology and it hinges on increasing revenues for the customer.